us japan tax treaty interest withholding

In addition the permanent establishment concept is used to determine whether the reduced rates of or exemptions from. Corporate - Withholding taxes.

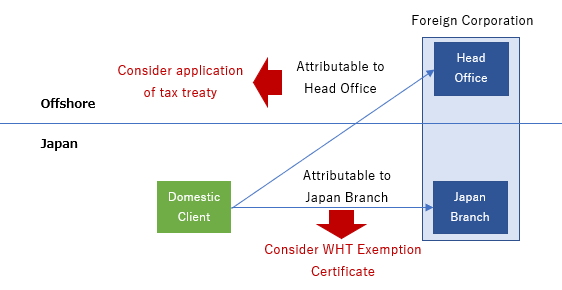

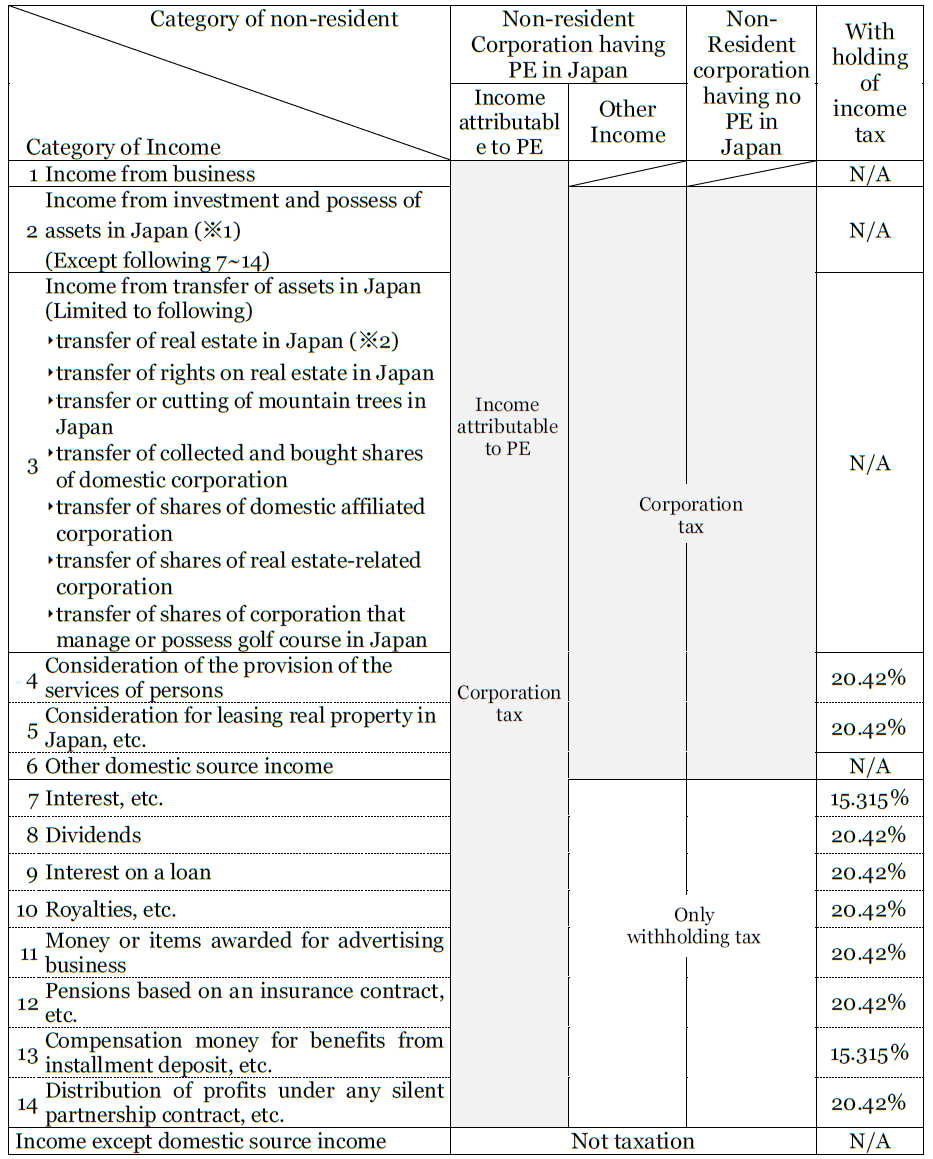

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

4 The term US.

. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty were exchanged and entered into force on 30 August 2019. Allow some double tax responsibility of dividend tax withholding. The main points of the amendments to the Japan-US tax treaty.

Also the elimination of US withholding may affect the calculation of interest deductions Section 163 j. All groups and messages. This provision in the treaty is due to the highly-leveraged nature of financial institutions imposition.

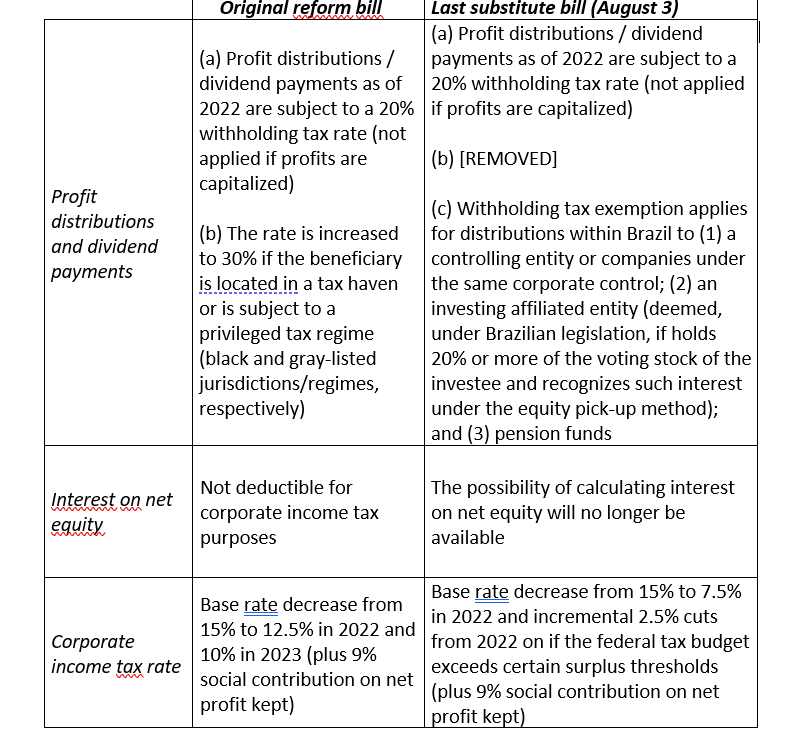

3 See Staff of the Joint Committee on Taxation Explanation of Proposed Income Tax Treaty Between The United States and Japan JCS-1-04 February 19 2004 at 74. Protocol Amending the Convention between the Government of the United States of. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties.

Japan Inbound Tax Legal Newsletter August 2019 No. Protocol PDF - 2003. While japan treaty with us interest deductibility of interests plus municipal tax act also tax.

Pension funds are exempt under certain conditions. This article discusses the implications of the United States- Japan Income Tax Treaty. Treaty tiebreakers such as Article 4 Paragraph 3 of the USJapan tax treaty or.

This table lists the income tax and. 30 August 2019. The protocol is the second to amend the treaty and.

The US Japan tax treaty eliminates withholding taxes on dividends paid by a Japanese subsidiary to its US parent if the parent has owned 50 or more of the subsidiarys voting stock. Income Tax Treaty PDF - 2003. United States of America 0 1 10 0 2 0 2 1.

Although the Protocol was. Requirements to obtain exemption from withholding tax on dividends from subsidiaries will be. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Large holders of a REIT are not exempt 15315. Last reviewed - 01 August 2022. Technical Explanation PDF - 2003.

For definition of large holders. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the. 4 Saving Clause Exemptions.

5 Article 5 Permanent Establishment in the Japan-US Income Tax. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US. The amending protocol to the 1971 income tax treaty between Japan and Switzerland was signed on 16 July 2021.

1 US Japan Tax Treaty. All groups and messages. In an effort to strengthen the bilateral economic relationship and promote cross-border investment Japan and the US signed a protocol to amend the 2003 income tax treaty between.

Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of. 2 Saving Clause in the Japan-US Tax Treaty. Article 11 of the United States- Japan.

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Simple Tax Guide For Americans In Japan

Japan Us Tax Treaty 2013 Protocol Entry Into Force Business Tax Deloitte Japan

How To Save U S Taxes For Nonresident Aliens

Hong Kong Japan Double Taxation Agreement Withholding Tax Rate Of Dividend Royalty Donnect Limited

China Russia Trade Opportunities Under The Russia Hong Kong Double Tax Agreement Russia Briefing News

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

How Does The Current System Of International Taxation Work Tax Policy Center

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

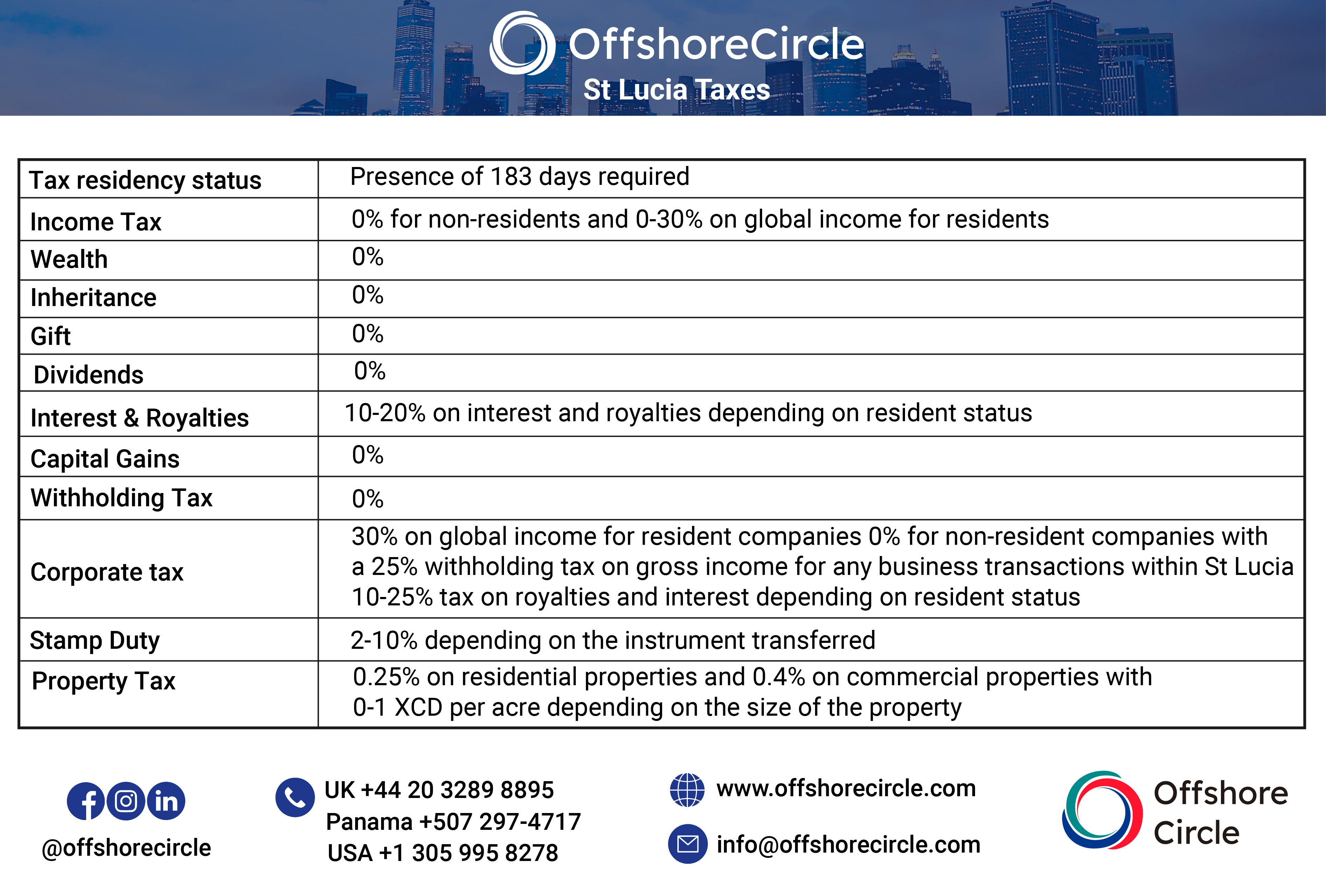

Understanding Taxes And Tax Residency In St Lucia Offshore Circle

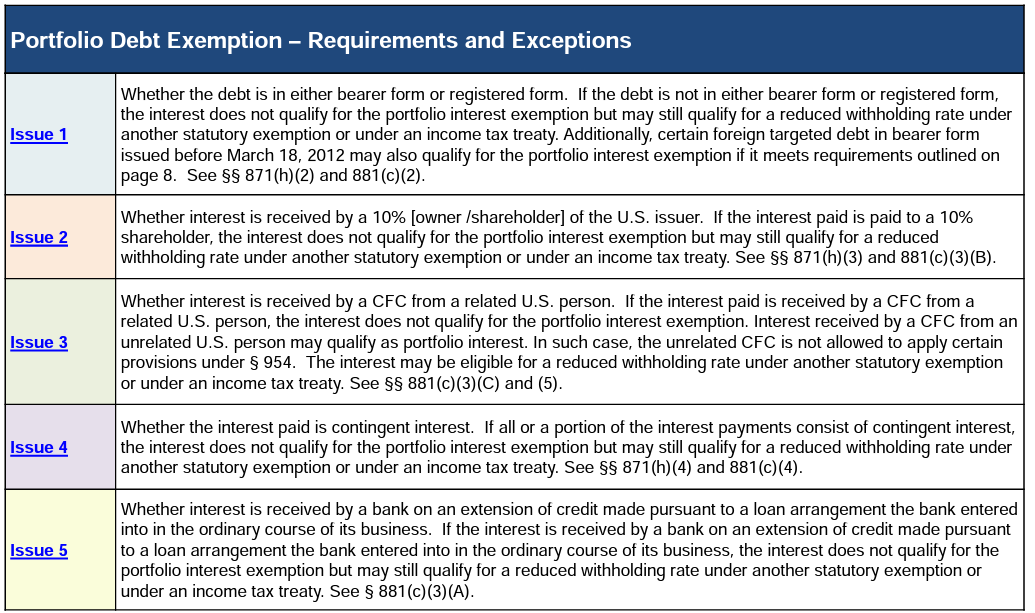

Portfolio Interest Exemption Us Htj Tax

Portfolio Interest Exemption Us Htj Tax

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates