how much is mass meal tax

A combined 10775 percent rate. The document makes clear that it begins with the credits required to be issued for the fiscal year ending June 30 2022 First DOR will calculate the excess revenue percentage.

Massachusetts Sales Tax Handbook 2022

Capital gains in Massachusetts are taxed at one of two rates.

. Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. First enacted in the.

How much is a typical meals tax. The sales tax imposed on a meal is based on the sales price of that meal. The cost of a Massachusetts Meals Tax Restaurant Tax is unique for the specific needs of each business.

Meals taxes tend to range from anywhere between 05 percent to as high as 55 percent. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. The sales price is the total amount paid by a purchaser to a vendor as consideration for the sale of the.

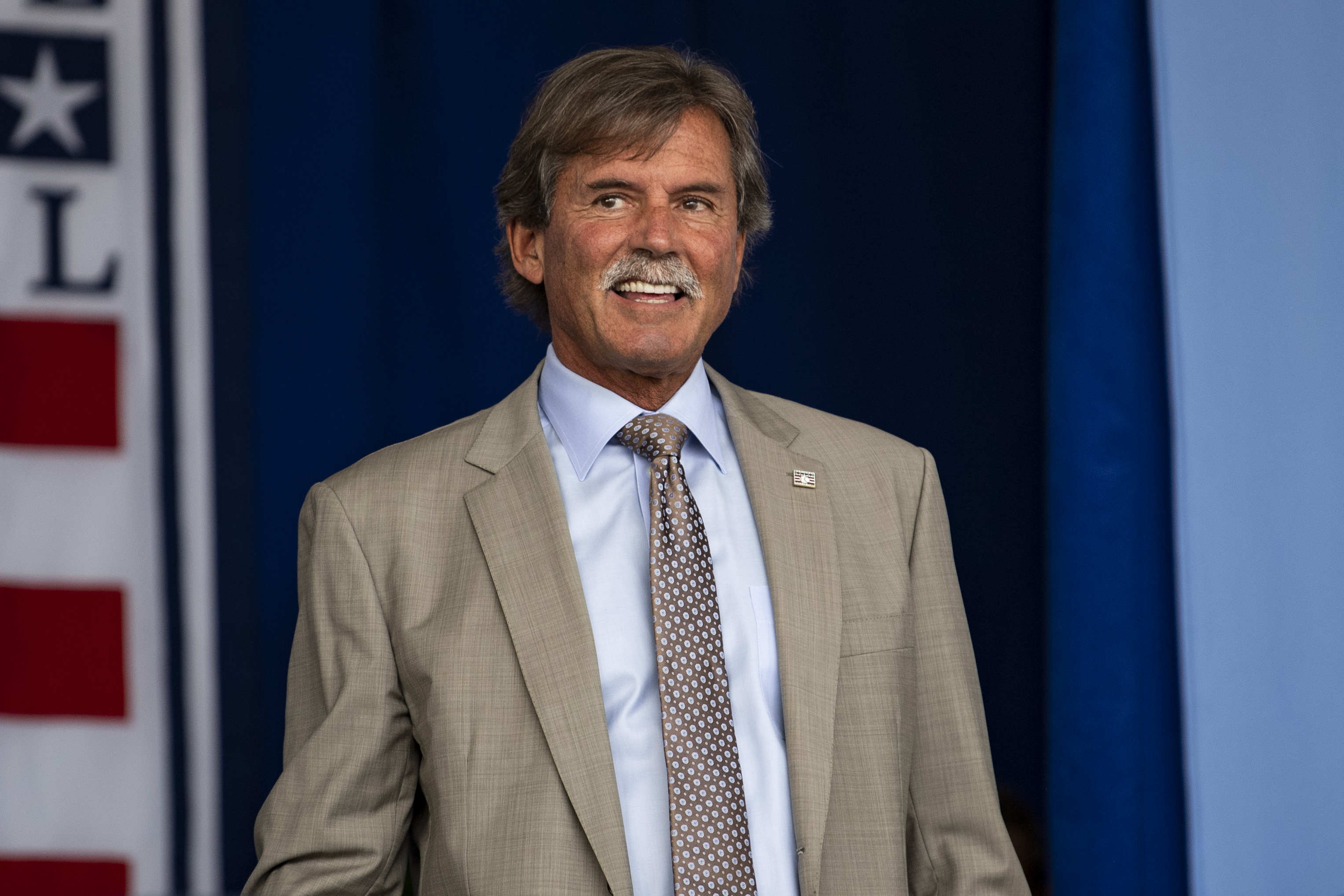

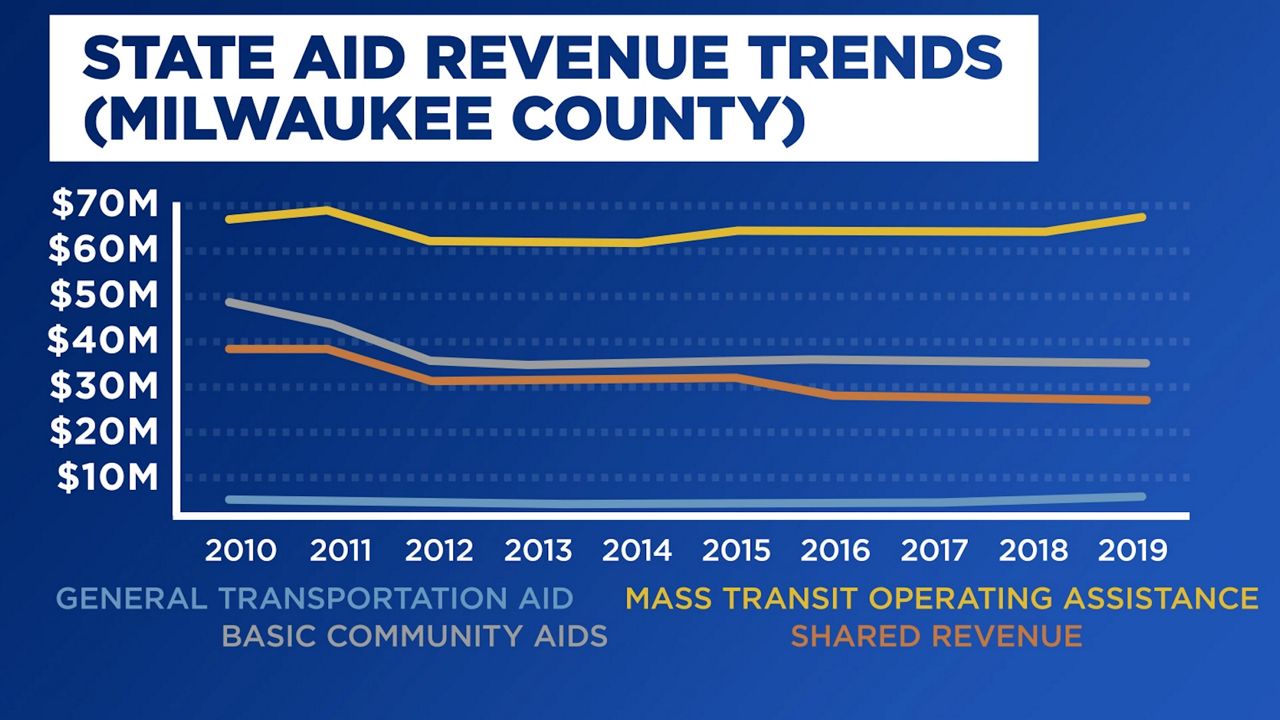

How Much Does It Cost to Get a Massachusetts Meals Tax Restaurant Tax. Cities like Miami Virginia Beach Milwaukee. Sales tax is calculated by multiplying the purchase.

Massachusetts doesnt have local sales tax rates only a statewide tax rate of 625. In the state of Massachusetts any service charge by a caterer is not considered to be taxable so long as the caterer prepares food which was owned by the client at a fixed location. Hotel rooms state tax rate is 57 845 in Boston Cambridge.

2022 Massachusetts state sales tax. Sales Tax Calculator. The federal estate tax has a much higher exemption level than the Massachusetts estate tax.

This means that the applicable sales tax rate is the same no matter where. Massachusetts Salary Tax Calculator for the Tax Year 202223 You are able to use our Massachusetts State Tax Calculator to calculate your total tax costs in the tax year 202223. A local option for cities or towns.

Massachusetts local sales tax on meals More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Combined rates are also high in Chicago Illinois 1075 percent Virginia Beach. The Massachusetts MA state sales tax rate is currently 625.

Combined with the state sales tax the highest sales tax rate in Massachusetts is 625 in the cities of Boston Worcester Springfield Quincy and Cambridge and 103 other cities. The tax is 625 of the sales price of the meal. Visitors to Minneapolis Minnesota pay the highest meals tax.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

Sales tax is a tax paid to a governing body state or local for the sale of certain goods and services. The meals tax rate is 625. The estate tax exemption is 1206 million for 2022.

The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1. We literally do less than one percent of sales in takeout and the profit margin is comparable three percent. A 625 state meals tax is applied to restaurant and take-out meals.

Most long-term capital gains as well as interest and dividend income are taxed at. So you would simply charge the state sales tax rate of 625 to buyers in Massachusetts. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where.

Exact tax amount may vary for different items. A local option meals tax of 075 may be applied. Massachusetts Capital Gains Tax.

We pay rent for seating space not kitchen space for takeout. The base state sales tax rate in Massachusetts is 625.

When Is Tax Free Weekend In Massachusetts Nbc Boston

Where Does Championship Run Revenue Go

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Real Time Sales Tax Collection Proposal Would Inflict New Costs On Business Provide No New Revenue To The State

Form Mvu 25 Affidavit In Support Of A Claim For Mass Gov Mass Fill Out Sign Online Dochub

4 Ways To Calculate Sales Tax Wikihow

Massachusetts Sales Tax Guide For Businesses

Mass May Tell Amazon To Charge Sales Tax The Boston Globe

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

Most Massachusetts Communities Home Sales Wouldn T Trigger Proposed Ballot Question 1 Tax Report Suggests Boston Business Journal

Massachusetts Estate Tax Everything You Need To Know Smartasset

Vesuvius Salem Menu In Salem Massachusetts Usa

Taso S Euro Cafe Menu In Norwood Massachusetts Usa

How Are Groceries Candy And Soda Taxed In Your State

No Sales Tax Weekend Aug 13th 14th Lynne Greene Interiors Hunter Douglas Gallery Ma

Amazon To Begin Collecting Mass Sales Tax Friday The Boston Globe